Page 251 - 進出口貿易與押匯實務疑難問題解析-參篇 (增修訂二版)

P. 251

第三章 出口押匯疑難問題 237

二、依據 UCP600 第 16 條 C 項 iii 款之規定

信用狀之開狀銀行、保兌銀行 (如有者)、或代理之指定銀行,如予

拒付時,該項通知應敘明該單據留候寄單銀行處置或正退還寄單銀行。

又依據國際商會決議,瑕疵單據經拒付後,單據之權利屬於受益人。決

議內容如下:

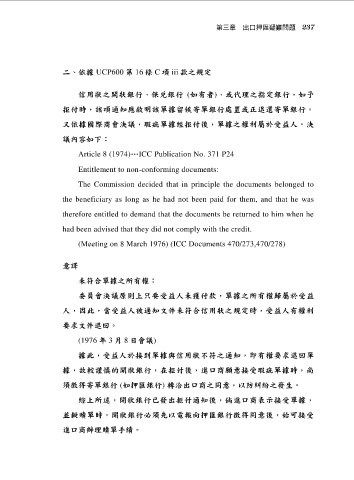

Article 8 (1974)…ICC Publication No. 371 P24

Entitlement to non-conforming documents:

The Commission decided that in principle the documents belonged to

the beneficiary as long as he had not been paid for them, and that he was

therefore entitled to demand that the documents be returned to him when he

had been advised that they did not comply with the credit.

(Meeting on 8 March 1976) (ICC Documents 470/273,470/278)

意譯

未符合單據之所有權:

委員會決議原則上只要受益人未獲付款,單據之所有權歸屬於受益

人,因此,當受益人被通知文件未符合信用狀之規定時,受益人有權利

要求文件退回。

(1976 年 3 月 8 日會議)

據此,受益人於接到單據與信用狀不符之通知,即有權要求退回單

據,故較謹慎的開狀銀行,在拒付後,進口商願意接受瑕疵單據時,尚

須徵得寄單銀行 (如押匯銀行) 轉洽出口商之同意,以防糾紛之發生。

綜上所述,開狀銀行已發出拒付通知後,倘進口商表示接受單據,

並擬贖單時,開狀銀行必須先以電報向押匯銀行徵得同意後,始可接受

進口商辦理贖單手續。