Page 35 - 進出口貿易與押匯實務疑難問題解析-肆篇

P. 35

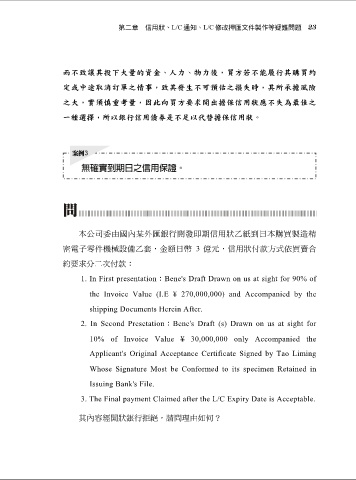

第二章 信用狀、L/C 通知、L/C 修改押匯文件製作等疑難問題 23

而不致讓其投下大量的資金、人力、物力後,買方若不能履行其購買約

定或中途取消訂單之情事,致其發生不可預估之損失時,其所承擔風險

之大,實須慎重考量,因此向買方要求開出擔保信用狀應不失為最佳之

一種選擇,所以銀行信用債券是不足以代替擔保信用狀。

本公司委由國內某外匯銀行開發即期信用狀乙紙到日本購買製造精

密電子零件機械設備乙套,金額日幣 3 億元,信用狀付款方式依買賣合

約要求分二次付款:

1. In First presentation:Bene's Draft Drawn on us at sight for 90% of

the Invoice Value (I.E ¥ 270,000,000) and Accompanied by the

shipping Documents Herein After.

2. In Second Presetation:Bene's Draft (s) Drawn on us at sight for

10% of Invoice Value ¥ 30,000,000 only Accompanied the

Applicant's Original Acceptance Certificate Signed by Tao Liming

Whose Signature Most be Conformed to its specimen Retained in

Issuing Bank's File.

3. The Final payment Claimed after the L/C Expiry Date is Acceptable.

其內容經開狀銀行拒絕,請問理由如何?