Page 224 - 進出口貿易與押匯實務疑難問題解析-肆篇

P. 224

212 進出口貿易與押匯實務疑難問題解析 (肆篇)

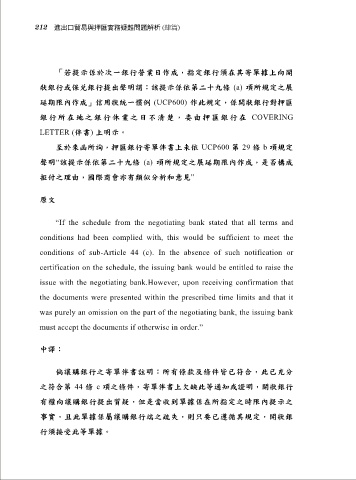

「若提示係於次一銀行營業日作成,指定銀行須在其寄單據上向開

狀銀行或保兌銀行提出聲明謂:該提示係依第二十九條 (a) 項所規定之展

延期限內作成」信用狀統一慣例 (UCP600) 作此規定,係開狀銀行對押匯

銀行所在地之銀行休業之日不清楚,委由押匯銀行在 COVERING

LETTER (伴書) 上明示。

至於來函所詢,押匯銀行寄單伴書上未依 UCP600 第 29 條 b 項規定

聲明“該提示係依第二十九條 (a) 項所規定之展延期限內作成,是否構成

拒付之理由,國際商會亦有類似分析和意見”

原文

“If the schedule from the negotiating bank stated that all terms and

conditions had been complied with, this would be sufficient to meet the

conditions of sub-Article 44 (c). In the absence of such notification or

certification on the schedule, the issuing bank would be entitled to raise the

issue with the negotiating bank.However, upon receiving confirmation that

the documents were presented within the prescribed time limits and that it

was purely an omission on the part of the negotiating bank, the issuing bank

must accept the documents if otherwise in order.”

中譯:

倘讓購銀行之寄單伴書註明:所有條款及條件皆已符合,此已充分

之符合第 44 條 c 項之條件,寄單伴書上欠缺此等通知或證明,開狀銀行

有權向讓購銀行提出質疑,但是當收到單據係在所指定之時限內提示之

事實,且此單據係屬讓購銀行端之疏失,則只要已遵循其規定,開狀銀

行須接受此等單據。