Page 79 - 台灣股市何種選股模型行得通?

P. 79

第 3 章 價值因子選股模型Ⅰ-股價淨值比 69

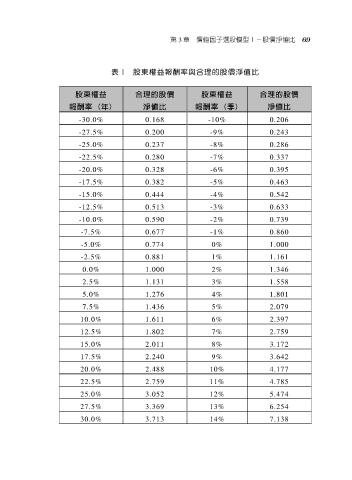

表 1 股東權益報酬率與合理的股價淨值比

股東權益 合理的股價 股東權益 合理的股價

報酬率 (年) 淨值比 報酬率 (季) 淨值比

-30.0% 0.168 -10% 0.206

-27.5% 0.200 -9% 0.243

-25.0% 0.237 -8% 0.286

-22.5% 0.280 -7% 0.337

-20.0% 0.328 -6% 0.395

-17.5% 0.382 -5% 0.463

-15.0% 0.444 -4% 0.542

-12.5% 0.513 -3% 0.633

-10.0% 0.590 -2% 0.739

-7.5% 0.677 -1% 0.860

-5.0% 0.774 0% 1.000

-2.5% 0.881 1% 1.161

0.0% 1.000 2% 1.346

2.5% 1.131 3% 1.558

5.0% 1.276 4% 1.801

7.5% 1.436 5% 2.079

10.0% 1.611 6% 2.397

12.5% 1.802 7% 2.759

15.0% 2.011 8% 3.172

17.5% 2.240 9% 3.642

20.0% 2.488 10% 4.177

22.5% 2.759 11% 4.785

25.0% 3.052 12% 5.474

27.5% 3.369 13% 6.254

30.0% 3.713 14% 7.138