Page 72 - NO.165銀行家雜誌

P. 72

特別報導

Special Issue

面的實力更强,其記憶體正遭受需求大幅下滑 幣的表現也在疫情期間、台灣大量出口時處於

的影響,從DRAM和NAND價格下跌可見一斑。 頂峰,如今表現相對疲軟,不足以緩解外需低

迷和電子行業去庫存的影響。同時,新台幣疲

通膨壓力大 家庭可支配收入受影響 軟帶來了通膨壓力,對台灣家庭的可支配收入

造成影響。近期人民幣走弱也為新台幣帶來了

外部需求曾支撐和幫助台灣經濟平穩渡過 額外的壓力,不排除會形成惡性循環的可能。

疫情,卻在後疫情時期成為最低迷的因素。此 聯準會和台灣央行之間的利差仍然高而進一步

外,當我們審視台灣的競爭力時會發現,新台 加劇壓力。

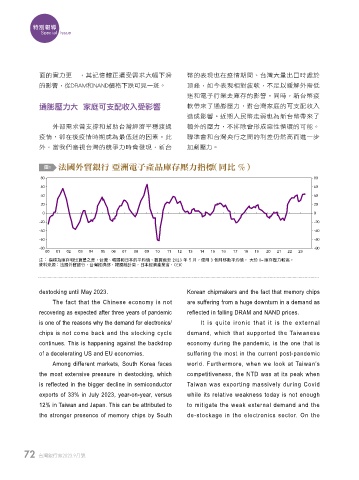

圖1 ج̮൱ვБ ԭݲཥɿପۜࢫπᏀɢܸᅺΝˢ %

80 - - 80

60 - - 60

40 - - 40

20 - - 20

0 - - 0

-20 - - -20

-40 - - -40

-60 - - -60

-80 - - -80

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23

注: 指標為庫存和出貨量之差,台灣、韓國和日本的平均值,數據截至 2023 年 5 月,使用 3 個月移動平均值。 大於 0= 庫存壓力較高。

資料來源:法國外貿銀行,台灣經濟部,韓國統計局,日本經濟產業省,CEIC

destocking until May 2023. Korean chipmakers and the fact that memory chips

The fact that the Chinese economy is not are suffering from a huge downturn in a demand as

recovering as expected after three years of pandemic reflected in falling DRAM and NAND prices.

is one of the reasons why the demand for electronics/ It is quite ironic that it is the external

chips is not come back and the stocking cycle demand, which that supported the Taiwanese

continues. This is happening against the backdrop economy during the pandemic, is the one that is

of a decelerating US and EU economies. suffering the most in the current post-pandemic

Among different markets, South Korea faces world. Furthermore, when we look at Taiwan’s

the most extensive pressure in destocking, which competitiveness, the NTD was at its peak when

is reflected in the bigger decline in semiconductor Taiwan was exporting massively during Covid

exports of 33% in July 2023, year-on-year, versus while its relative weakness today is not enough

12% in Taiwan and Japan. This can be attributed to to mitigate the weak external demand and the

the stronger presence of memory chips by South de-stockage in the electronics sector. On the

72 台灣銀行家2023.9月號

1 5% JOEE