Page 68 - 信用狀交易糾紛解析暨最新案例研討

P. 68

58

第一節 信用狀作業

一、信用狀之簽發

(一)開狀銀行簽發信用狀之義務

1. 開狀銀行義務之產生:依據 UCP600 第 7 條 b 項之規定,開狀銀行

自簽發信用狀時起,即受其應為兌付之不可撤銷之拘束。因此,依

據 UCP600 所簽發之不可撤銷跟單信用狀,自信用狀簽發時起,開

狀銀行之兌付承諾即已生效。

2. 相關議題

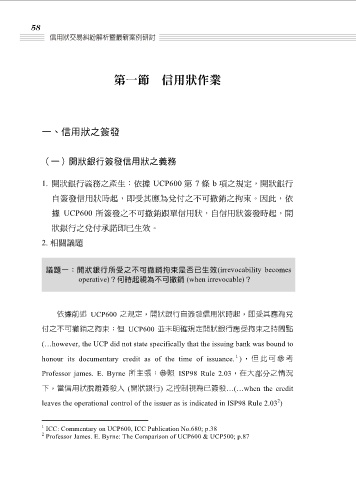

議題一:開狀銀行所受之不可撤銷拘束是否已生效(irrevocability becomes

operative)?何時起視為不可撤銷 (when irrevocable)?

依據前述 UCP600 之規定,開狀銀行自簽發信用狀時起,即受其應為兌

付之不可撤銷之拘束;但 UCP600 並未明確規定開狀銀行應受拘束之時間點

(…however, the UCP did not state specifically that the issuing bank was bound to

1

honour its documentary credit as of the time of issuance. ) ,但此可參考

Professor james. E. Byrne 所主張:參照 ISP98 Rule 2.03,在大部分之情況

下,當信用狀脫離簽發人 (開狀銀行) 之控制視為已簽發…(…when the credit

2

leaves the operational control of the issuer as is indicated in ISP98 Rule 2.03 )

1 ICC: Commentary on UCP600, ICC Publication No.680; p.38

2 Professor James. E. Byrne: The Comparison of UCP600 & UCP500; p.87