Page 45 - NO.161銀行家雜誌

P. 45

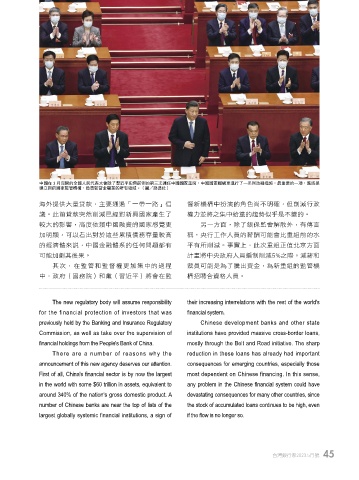

中國在 3 月召開的全國人民代表大會除了習近平史無前例的第三次連任中國國家主席,中國國家機構更進行了一系列改組措施,最重要的一項,應該是

建立新的國家監管機構,負責監督金融業的所有領域。(圖/路透社)

海外提供大量貸款,主要通過「一帶一路」倡 督新機構中扮演的角色尚不明確,但削減行政

議。此前貸款突然削減已經對新興國家產生了 權力並將之集中給黨的趨勢似乎是不變的。

較大的影響,高度依賴中國融資的國家感覺更 另一方面,除了銀保監會解散外,有傳言

加明顯,可以看出對於這些累積債務存量較高 稱,央行工作人員的薪酬可能會比重組前的水

的經濟體來說,中國金融體系的任何問題都有 平有所削減。事實上,此次重組正值北京方面

可能加劇其後果。 計畫將中央政府人員編制削減5%之際。減薪和

其次,在監管和監督權更加集中的過程 裁員可能是為了騰出資金,為新重組的監管機

中,政府(國務院)和黨(習近平)將會在監 構招聘合資格人員。

The new regulatory body will assume responsibility their increasing interrelations with the rest of the world's

for the financial protection of investors that was financial system.

previously held by the Banking and Insurance Regulatory Chinese development banks and other state

Commission, as well as take over the supervision of institutions have provided massive cross-border loans,

financial holdings from the People's Bank of China. mostly through the Belt and Road initiative. The sharp

There are a number of reasons why the reduction in these loans has already had important

announcement of this new agency deserves our attention. consequences for emerging countries, especially those

First of all, China's financial sector is by now the largest most dependent on Chinese financing. In this sense,

in the world with some $60 trillion in assets, equivalent to any problem in the Chinese financial system could have

around 340% of the nation's gross domestic product. A devastating consequences for many other countries, since

number of Chinese banks are near the top of lists of the the stock of accumulated loans continues to be high, even

largest globally systemic financial institutions, a sign of if the flow is no longer so.

台灣銀行家2023.5月號 45

1 5% JOEE