Page 411 - 進出口貿易與押匯實務疑難問題解析-肆篇

P. 411

第六章 其他與國際貿易金流相關問題 399

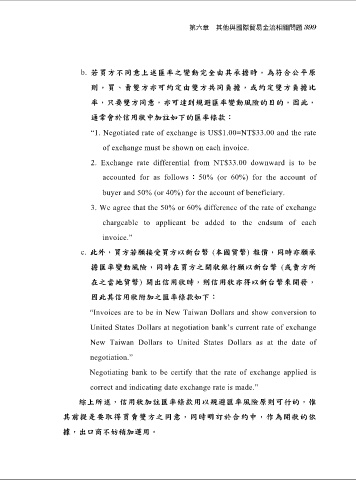

b. 若買方不同意上述匯率之變動完全由其承擔時,為符合公平原

則,買、賣雙方亦可約定由雙方共同負擔,或約定雙方負擔比

率,只要雙方同意,亦可達到規避匯率變動風險的目的,因此,

通常會於信用狀中加註如下的匯率條款:

“1. Negotiated rate of exchange is US$1.00=NT$33.00 and the rate

of exchange must be shown on each invoice.

2. Exchange rate differential from NT$33.00 downward is to be

accounted for as follows:50% (or 60%) for the account of

buyer and 50% (or 40%) for the account of beneficiary.

3. We agree that the 50% or 60% difference of the rate of exchange

chargeable to applicant be added to the endsum of each

invoice.”

c. 此外,買方若願接受買方以新台幣 (本國貨幣) 報價,同時亦願承

擔匯率變動風險,同時在買方之開狀銀行願以新台幣 (或賣方所

在之當地貨幣) 開出信用狀時,則信用狀亦得以新台幣來開發,

因此其信用狀附加之匯率條款如下:

“Invoices are to be in New Taiwan Dollars and show conversion to

United States Dollars at negotiation bank’s current rate of exchange

New Taiwan Dollars to United States Dollars as at the date of

negotiation.”

Negotiating bank to be certify that the rate of exchange applied is

correct and indicating date exchange rate is made.”

綜上所述,信用狀加註匯率條款用以規避匯率風險原則可行的,惟

其前提是要取得買賣雙方之同意,同時明訂於合約中,作為開狀的依

據,出口商不妨稍加運用。