Page 289 - 匯率衍生性金融商品

P. 289

參考文獻

279

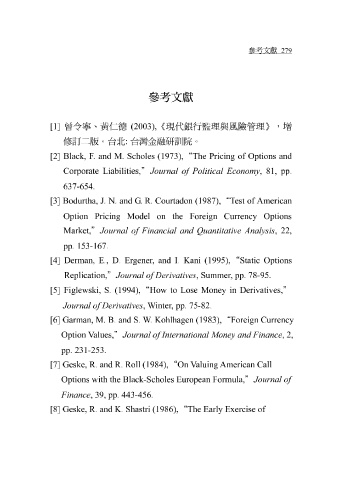

參考文獻

[1] 曾令寧 、 黃仁德 (2003), 《 現 代 銀 行 監 理與風險管理 》 , 增

修訂 二 版 。台 北: 台 灣 金融 研訓院 。

[2] Black, F. and M. Scholes (1973), “The Pricing of Options and

Corporate Liabilities, ” Journal of Political Economy , 81, pp.

637-654. “Test of American

[3] Bodurtha, J. N. and G. R. Courtadon (1987),

Option Pricing Model on the Foreign Currency Options ”Journal of Financial and Quantitative Analysis , 22,

Market,

S

[4] Derman, E., D. Ergener, and I. Kani (1995), pp. 153-167. “ tatic Options

Replication, ”Journal of Derivatives , Summer, pp. 78-95.

[5] Figlewski, S. (1994), “How to Lose Money in Derivatives, ”

Journal of Derivatives , Winter, pp. 75-82.

[6] Garman, M. B. and S. W. Kohlhagen (1983), “Foreign Currency

Option Values, ”Journal of International Money and Finance , 2,

pp. 231-253. “On Valuing American Call

[7] Geske, R. and R. Roll (1984),

Options with the Black-Scholes European Formula, ”Journal of

Finance , 39, pp. 443-456.

[8] Geske, R. and K. Shastri (1986), “The Early Exercise of